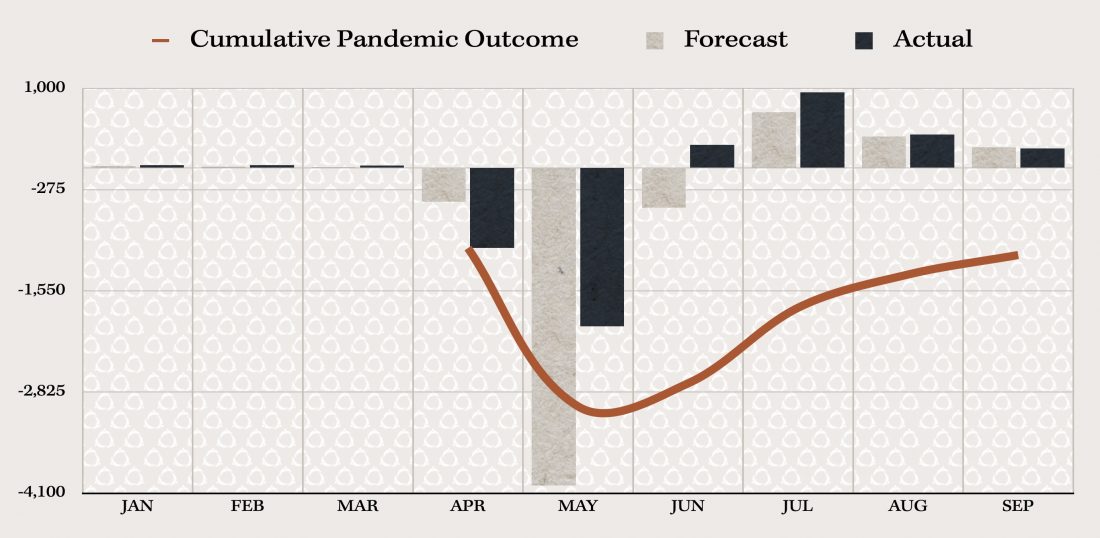

Five months out from the closing of Canada’s economy due to COVID-19, the labour force is beginning to observe a gradual recovery and is demonstrating cautious corporate and social optimism for the future. The unemployment rate in August dropped slightly to 10.2%, as total employment grew by 1.4% (245,800) for a total of 17,731,700—bringing employment levels within -5.7% of pre-COVID-19 levels.

To contrast, employment in July 2020 rose by 2.4% (419,000) compared with 5.8% (953,000) in June, which brought employment levels within -7.0% of pre-COVID-19 levels. This correlates with the reopening of the national economy around late May and early June, and the increase at a decreasing rate of employment now reflects tempered optimism as businesses attempt to balance an increase in capacity with the uncertainty prompted by the possibility of a second wave this fall.

Further, work from home continued to decline in August following the height of the trend in April. From a peak of 3.4 million Canadians working from home, only 2.5 million continued to do so through August. COVID-19 related absences continued to decline, now registering at 88.3% up from February levels.

Goldbeck has continued to facilitate placements in industries which are recovering well, including food processing and production equipment and management, and construction related industries. However, this uncertain optimism has hiring managers proceeding with caution.

“Some of our clients have paused hiring processes; others are continuing on with the anticipation of increasing capacity in the coming months,” says Henry Goldbeck, CEO of Goldbeck Recruiting.

“However, we are beginning to see which industries have comparatively thrived during the pandemic slowdown; these include healthcare and medical chemical and device industries, as we’d expect, as well as construction and related industries which have continued to hire throughout the height of pandemic response measures.” This is reflected in the job numbers this month, which again showed moderate but slowed growth as some industries thrived and others showed continued reticence to invest in new candidates.

August saw another familiar trend which accounts for slow improvements in unemployment: the vacation slowdown.

“Given the stress placed on the job market this year, we saw more companies encourage employees to take time off,” says Goldbeck. “Not only to alleviate workplace stress but also perhaps due to a shortage of work. This is a trend we see every year, and as such, we’re preparing for a busy September as companies attempt to return to full capacity.”

Lastly, with government support coming to an end, the job market will likely see greater fluctuations in coming months. “The end of government support could yield significant problems for small businesses struggling to make payroll,” says Goldbeck, “but will also likely prompt a greater uptake in part time work in student and youth populations. Ultimately,” says Goldbeck, “September will be a telling month, and we’re prepared to see numbers continue on a slow but steady upward trajectory or potentially fall quite sharply as they did earlier this year.”